Obviously Awesome - by April Dunford

Positioning is the act of deliberately defining how you are the best at something that a defined market cares a lot about.

If we fail at positioning, we fail at marketing and sales.

Customers need to be able to easily understand what your product is, why it’s special and why it matters to them. You can think of positioning as “context setting” for products. Without context, products are very difficult to understand, e.g., in a concert hall, Joshua Bell is perceived as producing something that is very valuable. But when he's playing outsie a subway station, he looks like just a street performer. His product hasn't changed, people don't recognize its value due to context.

Signs of weak positioning:

Your current customers love you, but new prospects can't figure out what you're selling, i.e., there's a disconnect between how your happy customers think about your product and how prospects see it.

Your company has long sales cycles and low clse rates, and you're losing out to the competition.

You have high customer churn because customers who misunderstood your value chose you for the wrong reasons.

You're under price pressure. You can't charge a premium for a product that seems exactly like everything else on the market.

Great positioning rarely comes by default.

The product we end up with is often not what we started to build, e.g. an email system seems more like group chat, and a database seems more like an analytics platform. Additionally, markets, and the way customers perceive them, are constantly changing.

Trap 1: You are stuck on the idea of what you intended to build, and you don’t realize that your product has become something else. For example, you might have intended to create a new dessert but it may be better positioned as a snack. Positioning the product as a dessert vs a snack can mean significant differences in:

- Target buyers and where you sell: Upscale restaurants vs coffee shops

- Competitive alternatives: Cakes and ice-creams vs Donuts and bagels

- Pricing and margin: Smaller volume, higher prices vs Higher Volume , lower prices

- Key product features and roadmap: Organic and gluten free vs More carmael.

Trap 2: You carefully designed your product for a market, but that market has changed.

For example, say you positioned you creation as a ‘diet snack’ but the new trend of health eating means a competitor offering something very similar positions it as a ‘gluten free paleo snack.

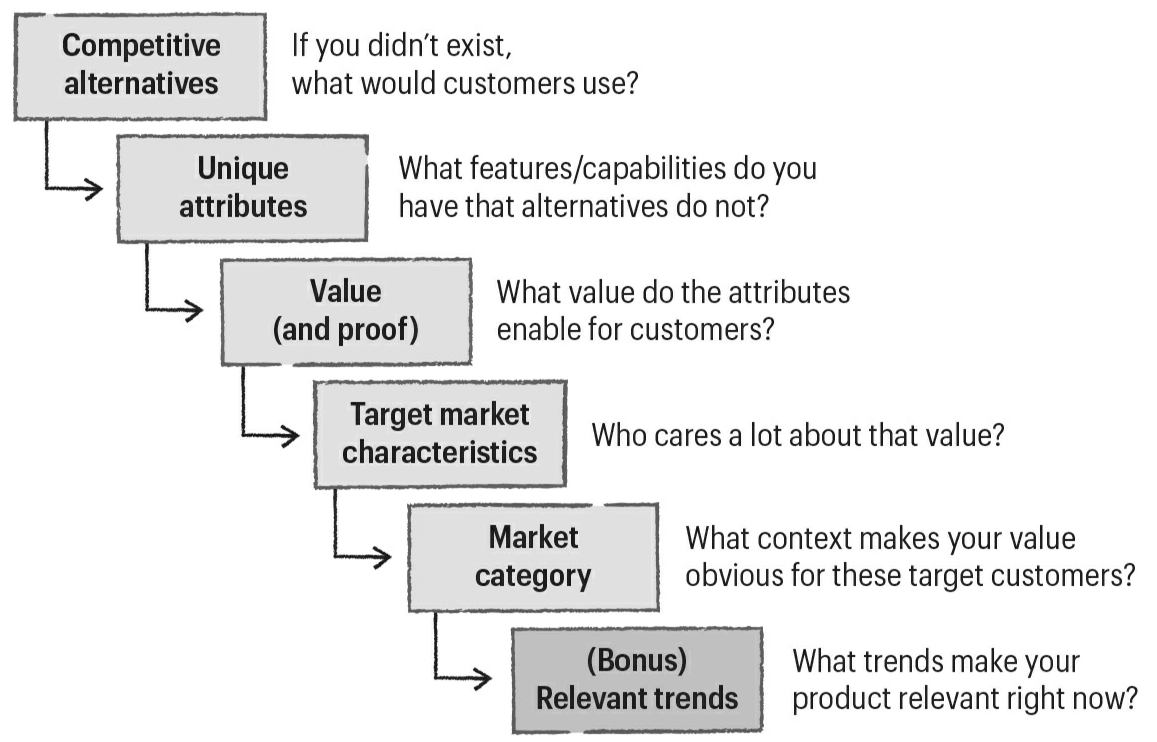

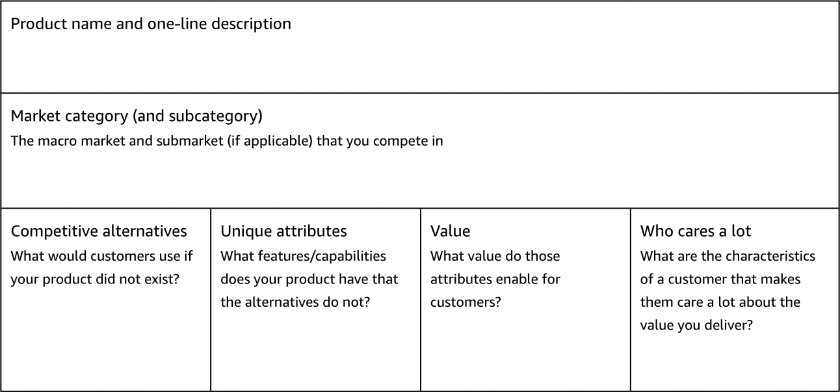

The Six Components of Effective Positioning

Competitive alternatives: What your target customers would "use" or "do" if your product didn't exist, i.e., what your customers compare your solution with and use as the yardstick to define "better".

Unique attributes: The features and capabilities that you have and the alternatives lack, e.g., Technical features, delivery model, specific expertise and experience.

Value (and proof): The reason why a customer should care about your unique attributes. Value should be fact-based, i.e., provable in an objective and demonstrable way. For example: the value of patented query algorithm is that companies can get answers from data in minutes rather than hours.

Target market characteristics: Your efforts need to be focused on the customers most likely to buy from you, and your positioning needs to identify who those folks are, i.e., the customers who care the most about the value your product delivers. Your target market is the customers buy quickly, rarely ask for discounts, and tell their friends about your offering.

Suppose you were running out of cash and if the team didn't close a certain amount of business by the end of the month, very bad things were going to happen. What types of customers would you focus on and why? What are the characteristics of those customers that make them more likely to buy?

We originally thought about our database target market as "any company with a very, very large amount of data." But that wasn't specific enough—loads of companies with a large maount of data only store it for backup and don't care about fast analysis. Then we asked ourselves who cares a lot about getting answers quickly from a large amount of data. One group was banks that had a very time-sensitive need to analyze data to quickly identify a potential security threat. This specificity of positioning allowed us to be really targeted in our sales and marketing—instead of focusing our marketing on any company with a lot of data, we could specifically target banks.

Your typical Engineering Director doesn’t care that much about having the best insights (especially if it requires more effort) because their job isn’t that dependent on it, i.e., Git metrics gives them something to measure that is accepted by the industry. Whereas, if you’re the person put in charge of developer productivity, developer insights, or transformation for an entire company, your job depends on being able to capture metrics and insights that are actually useful.

Market category: Market categories are shorthand that help customers quickly understand your product and whether or not they should consider buying it.

With a good category choice, you don't have to tell customers who your competitors are and you don't have to list every feature: because it's assumed that all products in the category have those functions.

A poor category choice can trigger assumptions that do not apply to our product, then a good portion of our marketing and sales efforts are going to be spent battling those assumptions.

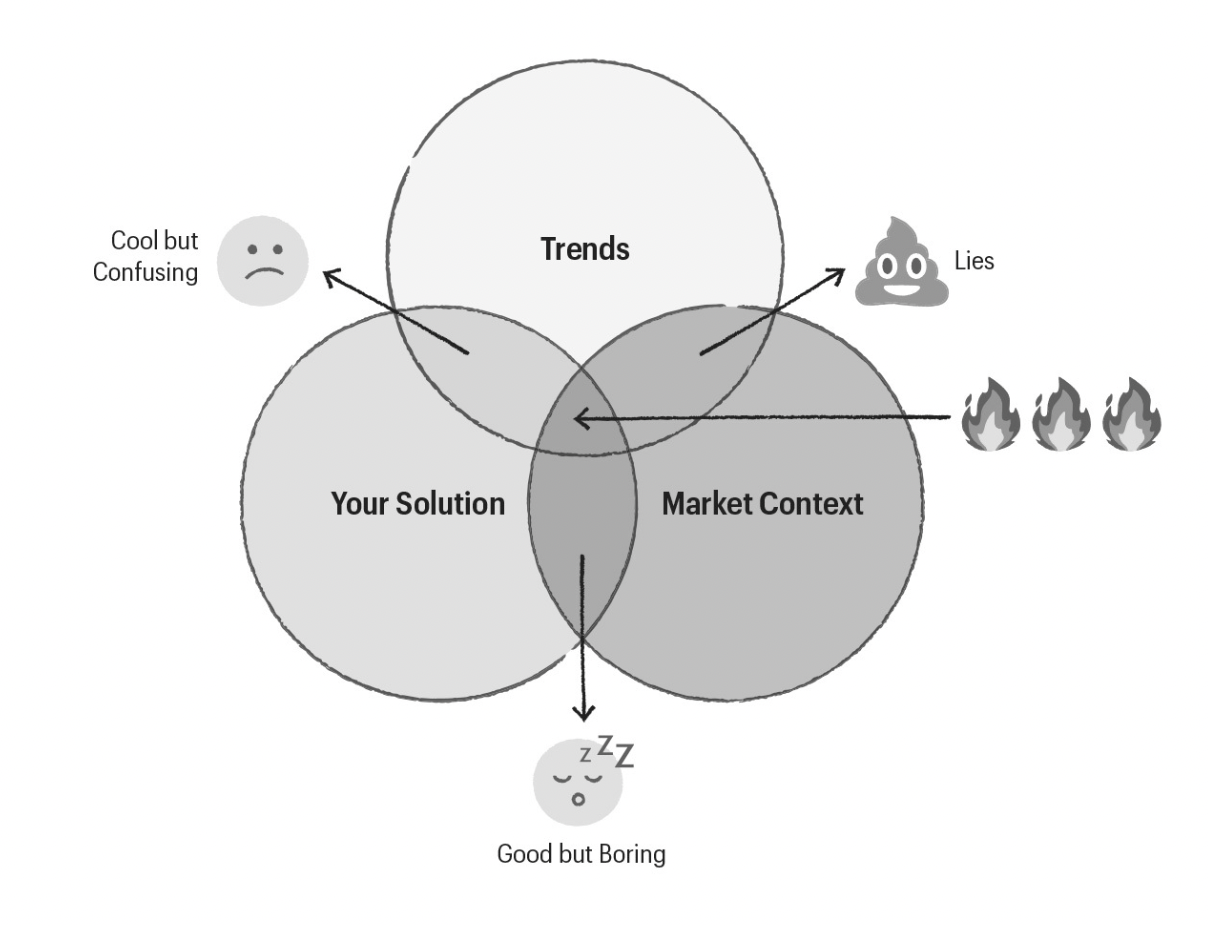

Relevant trends: Buyers are always interested in how the world is changing and want to learn about new, interesting and potentially disruptive approachs. Nobody wants to be left behind when a shift happens.

Whereas your market category puts your offering's strengths in their best context, trends help customers understand why your offering is something they need to pay attention to right now. Trends in technology can be applied to multiple market categories, e.g. AI-empowered CRM or decentralized marketplace.

The 10-step Positioning Process

1. Understand who loves your product most

The different components of positioning are interdependent, so start by making a short list of your super happy customers.

Your best-fit customers hold the key to understanding what your product is, and you can increase growth by concentrating on your best-fit customers (i.e., all of your buyers can look like the best-fit ones if you focus your marketing and sales efforts on companies with similar characteristics).

For multi-product companies: if most customers first encounter your company through the purchase of a particular product, position that single product first. If the company mainly sells a group of products together, position the company first, and worry about how much to focus on positioning products indiidually later.

Most of your target customers have never heard of you or your rival startups—they simply want to know how your product compares to what they use today.

2. Form a cross-functional team

Marketing can't "own" positioning. Positioning is too broad and too important to live in one silo of the overall company.

Positioning impacts:

- Marketing: messaging, audience targeting, and campaign development

- Sales and business development: target customer segmentation and account strategy

- Customer success: onboarding and account expansion strategy

- Product and development: roadmaps and prioritization

3. Let go of positioning "baggage"

Get on the same page regarding:

- What positioning means and why it is important

- Which compnents make up a position

- How market maturity and competitive landscape impact the style of positioning you choose for a product

Weak positioning starts with our disconnect between understanding the product as product creators, and understanding the product as customers first perceive it.

Get agreement from the team that, althought the product was created with a certain market and audience in mind, it may no longer be best positioned that way.

4. List your competitive alternatives

Customers don't always see competitors the same way we do, and their opinion is the only one that matters for positioning.

The features of our product and the value they provide are only unique, interesting, and valuable, when a customer perceives them in relation to alternatives.

Many cumpanies have weak positioning precisely because they don't clearly understand their true competitive alternatives in the minds of customers.

Understand what your best-fit customers might replace you with in order to understand how they categorize your solution - what would they do if we didn't exist?

Focus on the general case, i.e. if a new upstart compettir has a small number of customers, they are likely to have zero mindshare withp rospects and should not be listed as a real competitive alternative.

Remain focused on the best-fit customer list and name only what those customers would see as an alternative, and rank the list from most common to least common.

Cluster items if it's helpful to group them, e.g. a group called "do it manually" could include hiring an intern or using a spreadsheet, and a group called "use a small-business accounting solution" could include QuickBooks, Freshbooks, etc.

Teams usually end up with a minimum of two and maximum of five groups of alternatives.

5. Isolate your unique attributes and features

In this step, list all of the attributes and features you have that the alternatives do not, e.g. "15-megapixel camera" or "all-metal construction". Be broad and creative with the attributes you list, taking into account proprietary process, expertise in a special area, distribution models, partnerships, or special skills.

It can be helpful to think about feedback you get from customers when you ask them why they chose your offering. You might be the only consulting business with a certain combination of skills and experience. You might be the only company with a certain technology or a set of partnerships.

Focus on characteristics of your product or company that are based on objective facts or provable. For example, if you believe your company is "better at customer service", you could prove it with having more support people? Or for "ease of use", quantify is based on how long it takes to become proficient with your product versus alternatives? Third-party validation counts as proof, i.e. testimonials or case studies.

Concentrate on consideration attributes, i.e., things that customers care about when they are evaluating whether or not to make a purchase.

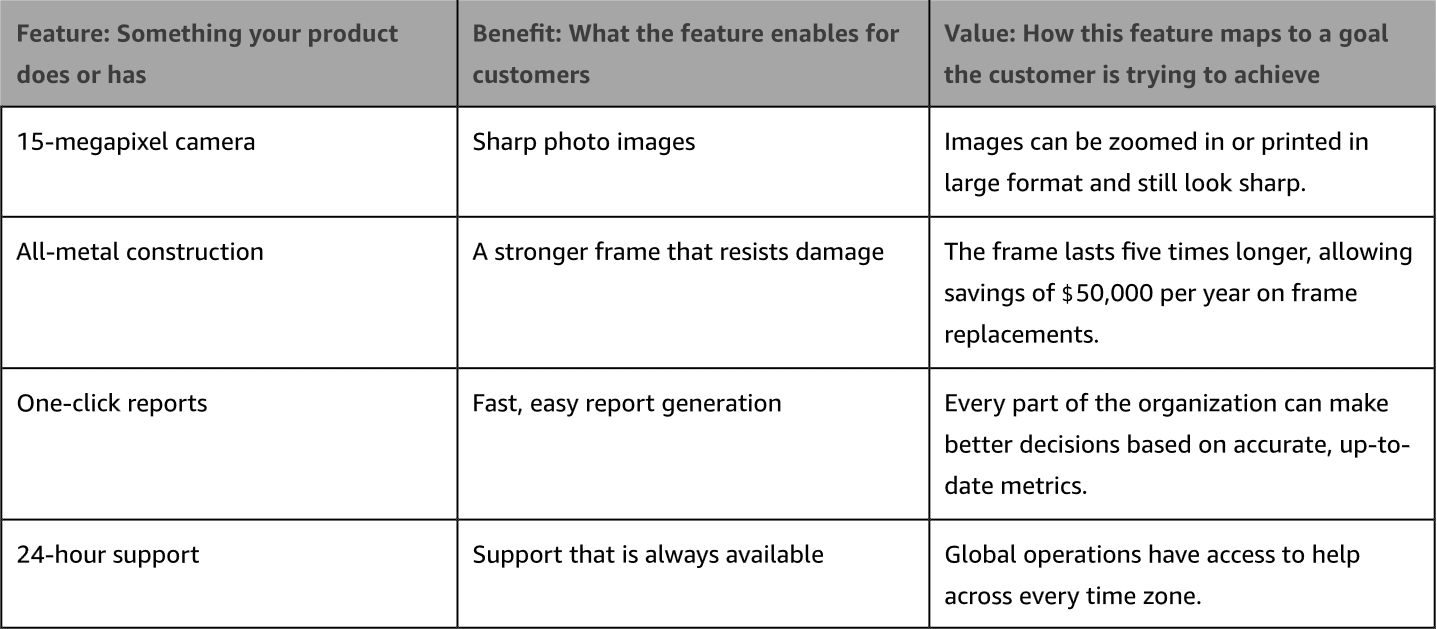

6. Map the attributes to value themes

It's important to be explicit about the value of our features to answer so what, why does is matter?

- Feature = Something your product does

- Benefit = What the feature enables for customers

- Value = How this feature maps to a goal the customer is trying to achieve

- Benefit = What the feature enables for customers

Examples:

Group points of value — as well as their respective attributes — down to one to four clusters (it's not uncommon to end up with just one). To do this, take the perspective of the customer and think about what points would naturally be related in their minds.

7. Determine who cares a lot

Not all customers care about your value in exactly the same way.

Create a list of a person's or a company's easily identifiable characteristics that make them care a lot about what you do. What makes some prospects more excited about your offerings than others, and why?

A segment can be defined by narrowing the set of buyers you are targeting, e.g. "account software" to "accounting software for freelancers or lawyers."

Target as narrowly as you can to meet your near-term sales objectives. Keeping your positioning focused is the most efficient use of your sales resources and fastest and easiest path to hitting your sales targets. You can broaden the targets later as your positioning naturally evolves.

8. Pick a market category

Next, you want to deliberately choose a market frame of reference that makes your value obvious to the segments who care most about that value.

A "market" needs to be something that already exists in the minds of customers (except in the rare decision to create a new market).

Ways to do this:

Isolate your key features and their value, and ask yourself, What types of products typically have those features? What category of products typically deliver that value?

Examine adjacent markets: there can be overlaps or blurry lines between markets, so it's good to look at neighboring markets.

Ask your customers, but take their answers with a grain of salt.

Picking a market is like giving customers an answer to the question, Who are you?

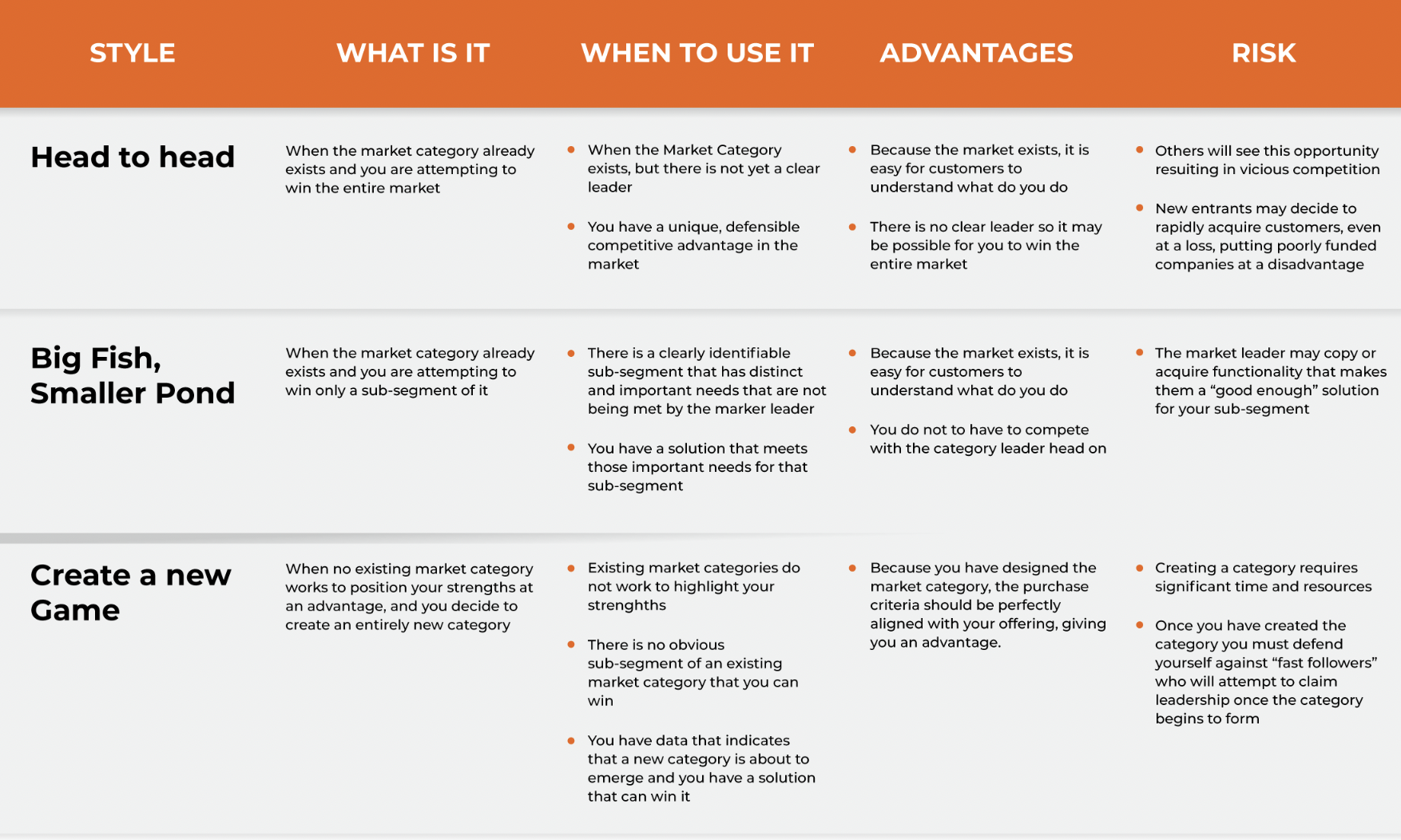

At a higher level, there are three different approaches to winning a market:

Head to Head: be the leader in a market category that already exists in the minds of customers. If there is an established leader, you need to convince customers that you are the best at delivering the solution for most, if not all, custoners.

Big Fish, Small Pond: dominate a subsegment of an existing market who have different requirements that are not being met by the current overall market leader.

Create a New Game: Positioning to win a market you create. You need to first prove to customers that a new market category deserves to exist, then define the parameters of that market in the minds of customers, and lastly, position yourself as the leader within it.

9. Layer on a trend

Now, think about how you can layer a trend on top of your positioning to help potential customers understand why your offering is important to them right now.

This step is optional — a product that is well positioned can be very successful without relating it to a trend. But if a current trend helps reinforce your positioning and the value that your offerings deliver, you can use it to your advantage.

10. Capture and operationalize your positioning

Capture your positioning in a document with enough detail that it can be used by marketing, sales, and product creation.

Next:

- Translate your positioning to a sales story

- Translate the sales story arc into messaging that can be used in marketing and sales materials, for campaigns and on the website.

- A messaging document helps yhou keep a record of the accepted baseline messaging, gives everyone a common starting point for building specific copy for a specific purpose, and keeps the language and positioning from evolving too far awy from the defined starting point.

- A change in positioning changes the way the company thinks about itself, which usullay has an impact on the product roadmap. Great positioning is usually strengthened over time with adjustments in features.